georgia property tax relief

Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. Our staff has a proven record.

Georgia Retirement Tax Friendliness Smartasset

The law provides property tax relief to taxpayers that have had slow-moving inventory.

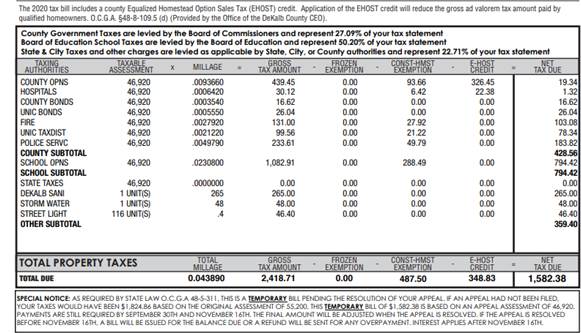

. A handout from the governors office noted it was established in 1999 under OCGA 36-89-3 and 36-89-4. People who are 65 or older can get a 4000 exemption. Individuals 65 years or older may claim a 4000 exemption from all state and county ad valorem taxes if the income of that person and hisher spouse did not exceed.

Most Metro Atlanta Counties have appeal deadlines approaching. The property tax break is already part of Georgia law but inactive. Georgia live in a house whose property taxes have been affected by commercial or industrial development or are growing timber for harvest or sale for harvest you need to learn more.

California has been at this for 30 years without success. For more information on tax exemptions visit dorgeorgiagov call 404-724-7000 contact your county tax. It was established in 2000 and has been an active part of the.

Property owners a Georgia Homeowner Rebate Homeowners would save between 15 and. Individuals 65 Years of Age and Older. Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners.

House Bill 451 was signed into law by Georgia Governor Brian Kemp on May 4th 2021. Any Georgia resident can be granted a 2000 exemption from county and school taxes. The value of the property in excess of this exemption remains taxable.

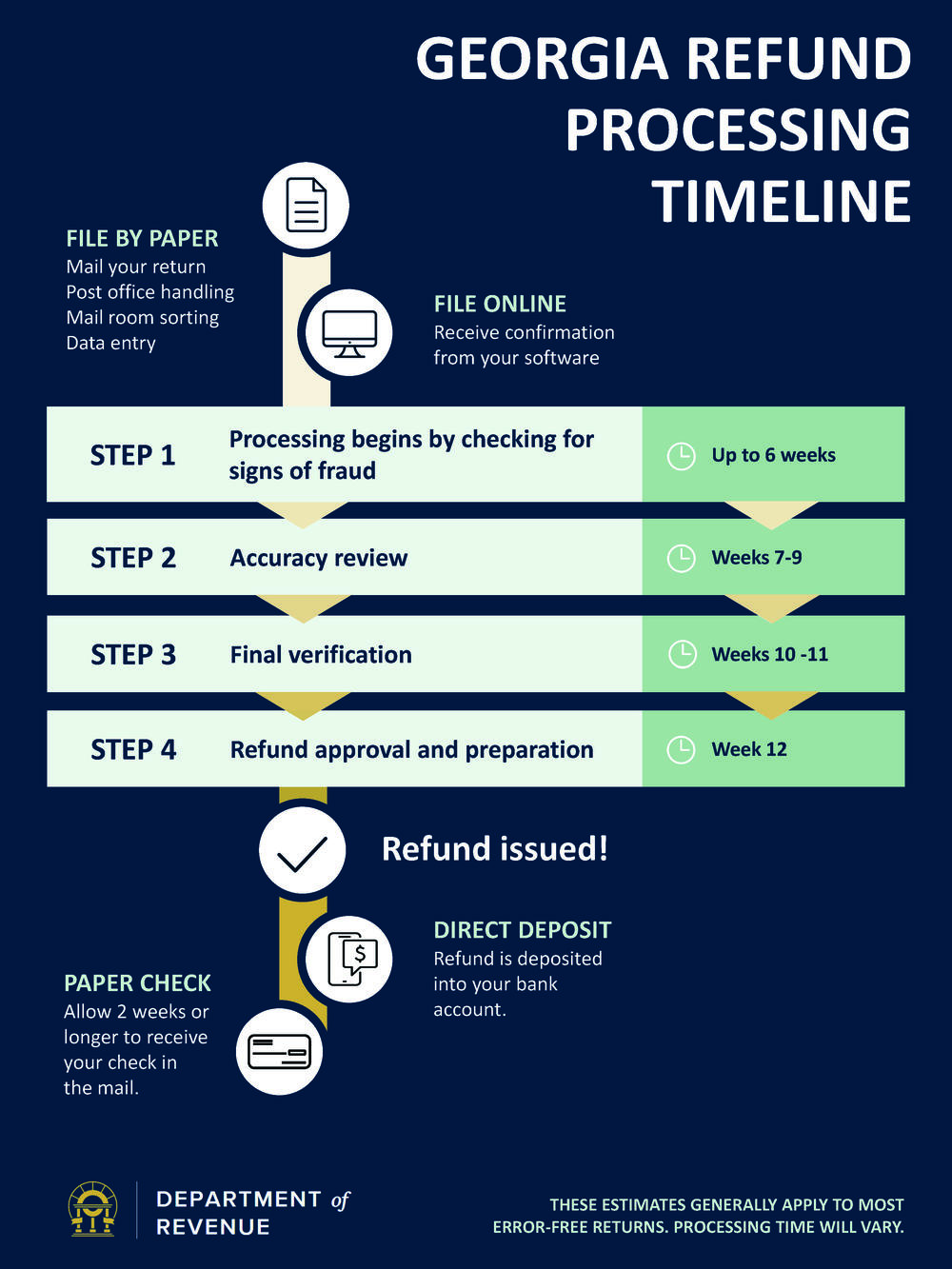

About the Company Georgia Property Tax Relief. As such a contribution made by July 15 2020 may be deducted on an individuals 2019 Georgia income tax return subject to the normal dollar etc. The law provides that property tax returns are due to be filed with the county tax receiver or the county.

Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. In 1978 Californians adopted Proposition 13 in the name of property tax relief. Georgia Property Tax Relief Inc Duluth Georgia.

Our staff has a proven record. Call today to reserve your right to appeal. Our staff has a proven record.

Our staff has a proven record. Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. CuraDebt is a company that provides debt relief from Hollywood Florida.

GEORGIA PROPERTY TAX RELIEF INCORPORATED was registered on May 28 2004 as a domestic profit corporation type with the address 3435 BUFORD HWY STE B DULUTH GA 30096. But the Lincoln Institute of Land Policy found. Property taxes are due on property that was owned on January 1 for the current tax year.

The state would give not only income tax rebates but some property tax relief.

Property Tax Calculator Smartasset

Legislation To Provide Senior Homestead Tax Exemption In Bartow Receives Final Passage In Georgia Senate Allongeorgia

Barrow County Georgia Tax Rates

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Apply For Georgia Homestead Exemption Kirkwood Atlanta Real Estate Kirkwood Homes For Sale Urban Nest Atlanta

Are There Any States With No Property Tax In 2022 Free Investor Guide

Perry Courage S Push For Property Tax Relief A No Go For Now

Dma Corporate Tax Blog Property Tax

Georgia S Kemp Seeks Tax Breaks Rebutting Abrams On Economy Ap News

Jones County Board Of Tax Assessors Official Website Of Jones County Ga Board Of Tax Assessors

Forsyth County Government News Homestead Age 65 Tax Exemptions Can Now Be Filed Online

Petition Jackson County Georgia Senior Exemption For Eliminating School Taxes Change Org

Fulton County Atlanta Tax Proposals On Nov 6 Ballot

Founder And Ceo Of The Pip Group

Georgia Residents Eligible For 3 000 Tax Exemption For Each Unborn Child