greenville county property tax estimator

Greenwood County Tax Estimator South Carolina SC. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current.

Yearly median tax in Greenville County.

. Welcome to the Greenville County Geographic Information Systems GIS homepage. If paying by mail please make your check payable to Greenville County Tax Collector and mail to. --Select one-- Camper - 1050 Vehicle Business - 1050 Vehicle Individual - 600 Watercraft - 1050.

Our South Carolina Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax. 2500 Stonewall Street Suite 101 Greenville TX 75403. Our Laurens County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax.

Greensville County is ranked 2395th of the 3143 counties for property. Thank you for your patience while we upgrade our system. Lexington County explicitly disclaims any representations and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose.

For an estimation on county taxes please visit the Greenville county or Laurens county. This site does not calculate taxes for Agricultural or Multi-use properties. The average yearly property tax paid by Greensville County residents amounts to about 12 of their yearly income.

Whether you are already a resident or just considering moving to Greenville County to live or invest in real estate estimate local property. Our mission is to provide accurate and timely geographic information system. The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a.

Estimated Range of Property Tax Fees. Our Greenville County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100.

Estimate My South Carolina Property Tax. The Greenville County Property. This is a TAX ESTIMATE only Estimate NOT applicable on split ratio properties.

This is only an estimate of taxes. The median property tax on a 14810000 house is 97746 in Greenville County. Tax Collector Suite 700.

The Greenville County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Greenville County. Greenville County South Carolina. It is based upon the millage fees charges values and calculation formulas in effect.

Learn all about Greenville County real estate tax.

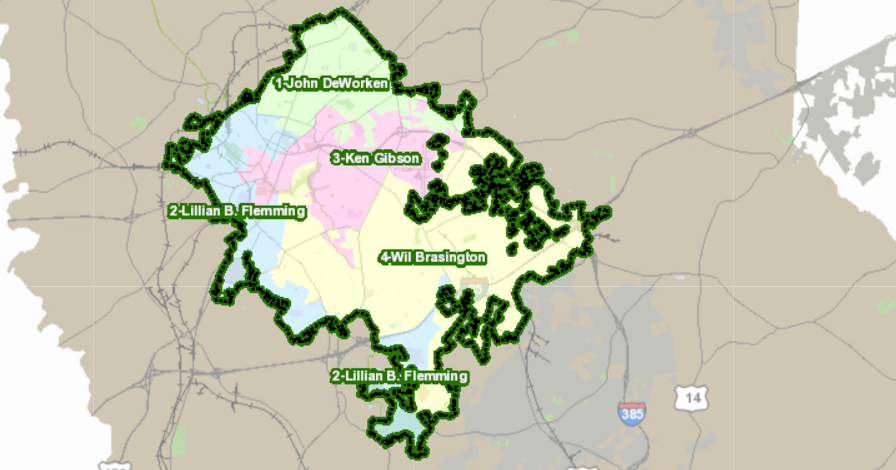

Greenville Growth Requires Redrawn City Council Districts With Equity The Elusive Goal Greenville Politics Postandcourier Com

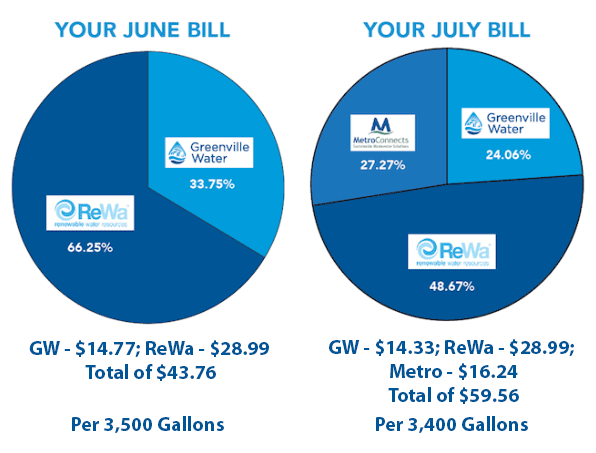

Cost Savings Through Consolidated Billing Greenville Water

Hunt Tax Official Site Greenville Tx

Why Retire In Greenville Sc Retiring In Greenville Guide

Ultimate Guide To Understanding South Carolina Property Taxes

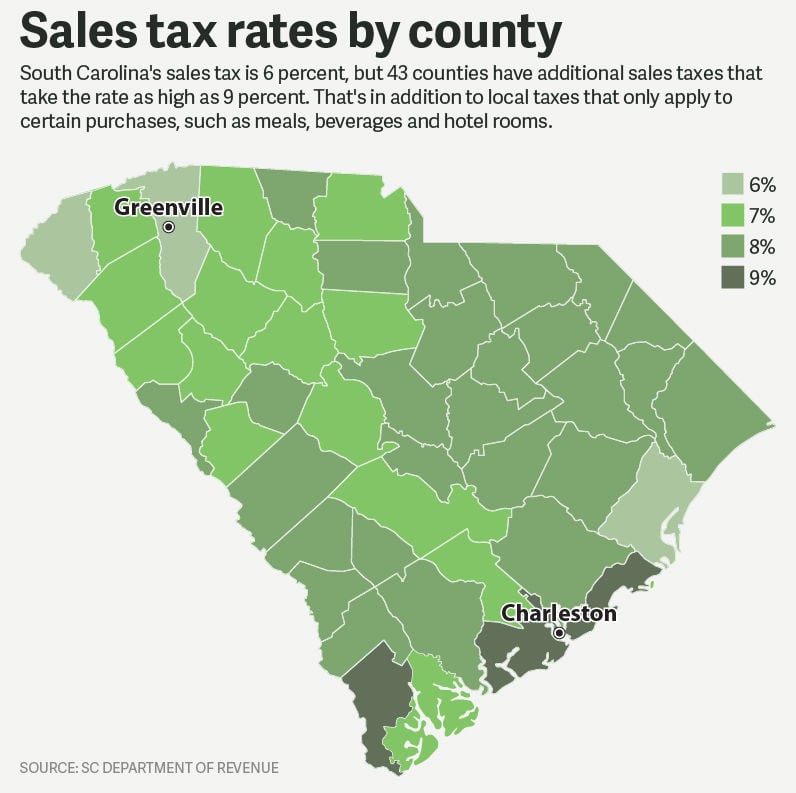

Greenville S A Rare Exception As Local Sales Taxes Have Spread To Most Sc Counties News Postandcourier Com

Columbia Tax Modernization Committee Hears Property Tax Concerns Wltx Com

Food Insecurity In Greenville County Gvltoday

How Greenville County Assesses Taxes The Home Team

Deep Dive Fee In Lieu Of Tax Agreements Remain A Useful Tool In Attracting Investment Greenville Journal

United Way Of Greenville County Uwgreenvillesc Twitter

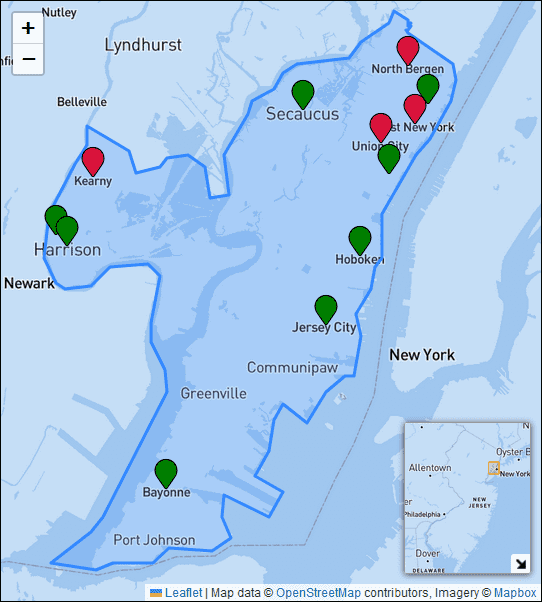

Property Tax Rates Average Tax Bills And Average Home Valuations In Hudson County New Jersey

Greenville Sc Real Estate Market Stats Trends For 2022

Property Taxes Useful Tips Charleston Sc Kristin B Walker Realtor

Greenville County South Carolina Wikipedia

Why Land Values Are Rising In Greenville County South Carolina